Holders of Jeanswest gift cards are reminded to redeem them as soon as possible while administrators of the retail chain consider its future.

Commissioner for Consumer Protection Lanie Chopping said Jeanswest customers should use their gift card sooner rather than later.

“We are advised that the stores are trading as normal and gift cards will be honoured, so customers should get in now and redeem them while these current arrangements are in place just to be on the safe side,” Ms Chopping said.

“When retail stores face financial difficulty, gift card holders and those who have paid a deposit but not received their goods can be at risk. We recommend reducing that risk by using the gift cards now and check arrangements for any outstanding orders to be delivered.

“Administrators can change the terms and conditions of the gift cards which, in the past, has meant that some customers must make further purchases in-store before they can redeem the value of the gift card.

“This is why we always recommend consumers who receive gift cards spend them as soon as possible. Ultimately, we recommend people buy a gift or give cash rather than risk giving a gift card that may get discarded or forgotten about.”

New laws related to gift cards came into force in November last year which, apart from some minor exceptions, means they must now have a minimum three year expiry date. Traders are required to clearly state the expiry date on the card and consumers are urged to check that it complies with the new mandatory three-year non-expiry period.

The other major change is that traders cannot charge post-purchase fees or administration charges that will reduce the value of your gift card, such as activation, account keeping and balance enquiry fees.

With a number of businesses facing financial difficulty, Consumer Protection has some golden rules that protect consumers so they are not exposed to too much risk.

“Avoid paying large deposits and never pay the total amount upfront. Staging payments for work completed or goods delivered is often a more sensible approach. Credit card chargeback rights may provide a level of protection in the event of non-delivery of goods but by paying a small deposit and the balance upon delivery, any potential losses are minimised,” the Commissioner said.

“When retailers shut down, consumer guarantees on goods must be honoured by the manufacturer so claims for repairs or replacements should go to them direct.”

Consumers affected by a business in administration or one that has closed its doors should follow the instructions of the administrator or liquidator.

Stolen Ford Mustang linked to southern suburbs incidents

Stolen Ford Mustang linked to southern suburbs incidents

Baldivis: Truck fire forces closure of Kwinana Freeway

Baldivis: Truck fire forces closure of Kwinana Freeway

Concerns for missing Baldivis girl

Concerns for missing Baldivis girl

MARC leisure pool, pirate playground to close for several weeks due to maintenance works

MARC leisure pool, pirate playground to close for several weeks due to maintenance works

Petition launched to change new Eastern Foreshore playground due to safety concerns

Petition launched to change new Eastern Foreshore playground due to safety concerns

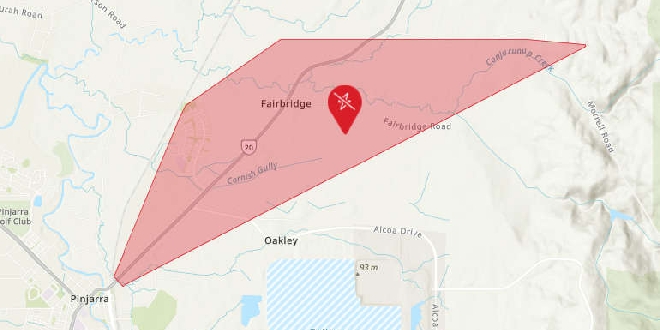

Parts of Pinjarra, Fairbridge without power

Parts of Pinjarra, Fairbridge without power

Bouvard scrub fire deemed suspicious

Bouvard scrub fire deemed suspicious

Peel Thunder crush Perth in WAFLW season opener

Peel Thunder crush Perth in WAFLW season opener

Baldivis man charged after AFP seize haul of cigarettes, vapes, $2.6M cash

Baldivis man charged after AFP seize haul of cigarettes, vapes, $2.6M cash